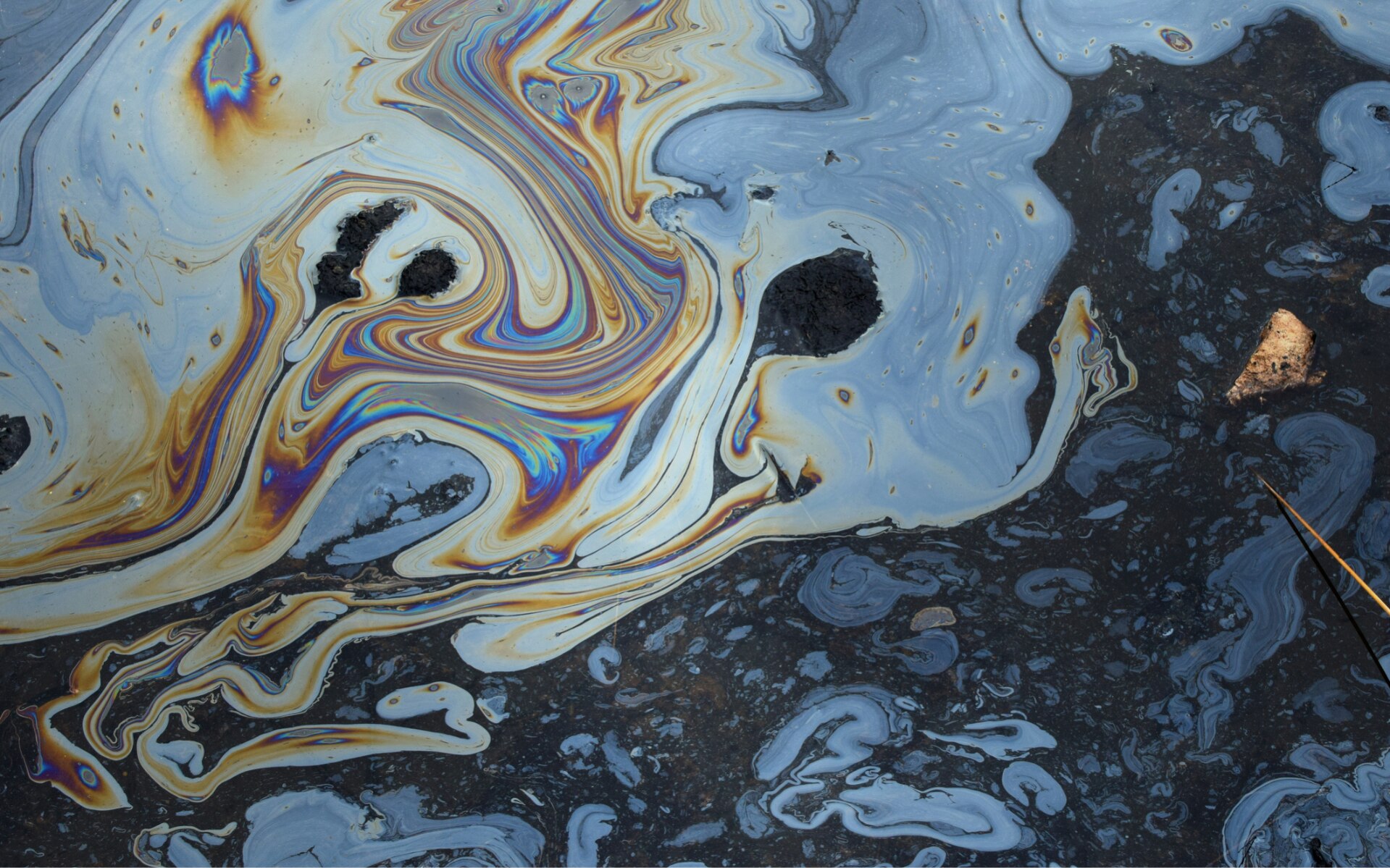

Tough legislation, media attention and keen community awareness, along with the possibility of delayed, 'long-tail' claims, make businesses of all kinds increasingly vulnerable either as the cause of the pollution or as the victim of natural disaster.

With Liberty, the policy is only part of the deal. Our underwriters and risk managers are well versed in dealing with the technical issues of complex risks and work side-by-side with brokers and clients to identify potential risks and suggest appropriate products. Our claims team works closely with clients to achieve a fair, timely and effective resolution of claims.

Liberty's environmental impairment products help to protect against four potential losses arising from a pollution incident:

- Clean up costs - this can be the main expense and is the cost of removing contaminants and pollutants. It can also include the clean-up of a third-party site, including a waterway or crown land.

- Costs of mitigation and emergency response.

- Public relations and crisis containment expenses.

- Costs incurred through Environmental Protection Authority (EPA) orders, including costs that the EPA incurs itself.

Contractor's Pollution Liability

Liberty’s Contractor’s Pollution Liability policy helps protect a contractor from third-party claims arising from pollution caused by their activities at a third-party site, and can be written on a practice or project-specific basis.

At a glance

Downloads

Helpful content

Find an underwriter

Fixed Site Pollution Liability

Liberty’s Fixed Site Pollution Liability policy helps to protect the client from claims resulting from pollution coming from their site. It helps protect the assets of a company by filling the gap created by the limited pollution cover provided under a standard liability and property insurance policy.

At a glance

Downloads

Helpful content

Find an underwriter

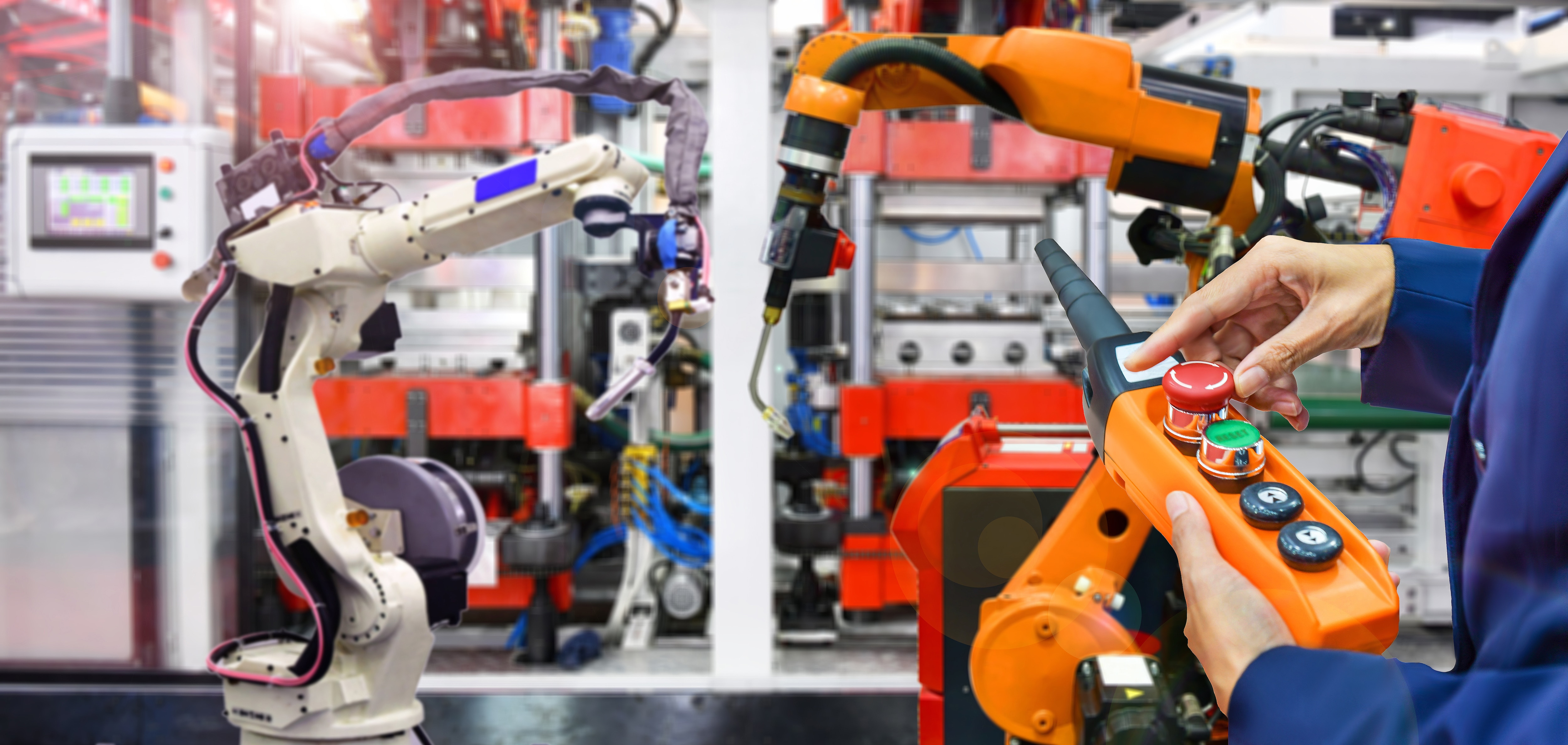

SME Manufacturing Premises Pollution

Liberty's SME Manufacturing Premises Pollution policy is specifically tailored for businesses with annual sales of less than SGD 25,000,000.

At a glance

Downloads

Find an underwriter

Our Environmental specialists

Click below to find contacts from across our Asia Pacific business.